In response to climate change and future net-zero greenhouse-gas emission standards for the industry, some manufacturers are already aligning their long-term business strategies with these environmental goals by investing in the future electric vehicle market and pushing for more energy efficiency through electrification. Bosch Group will acquire the assets of U.S. chipmaker TSI Semiconductors, based in Roseville, California, to expand its semiconductor business. As a foundry for application-specific integrated circuits (ASICs), TSI Semiconductors develops and produces large volumes of chips on 200-milimeter silicon wafers for applications in the mobility, telecommunications, energy and life sciences industries. Danfoss President and CEO Kim Fausing spoke at the International Energy Agency’s 8th Annual Global Conference on Energy Efficiency, declaring that net-zero goals won’t be met without electrification.

Bosch continues development of silicon carbide semiconductor chips

In the next few years, Bosch intends to invest more than $1.5 billion in the Roseville site and upgrade the TSI Semiconductors manufacturing facilities processes. Starting in 2026, following a retooling phase, the first chips will be produced on 200-millimeter wafers based on the innovative material silicon carbide (SiC) in a facility offering roughly 10,000 square meters of clean-room space.

Bosch said it is systematically reinforcing its semiconductor business with plans to significantly expand its global portfolio of SiC chips by the end of 2030. The full scope of the planned investment will be heavily dependent on federal funding opportunities available via the CHIPS and Science Act of 2022, as well as economic development opportunities in California. Bosch and TSI Semiconductors have reached an agreement to not to disclose any financial details of the transaction, which is subject to regulatory approval.

“With the acquisition of TSI Semiconductors, we are establishing manufacturing capacity for SiC chips in an important sales market while also increasing our semiconductor manufacturing globally. The existing clean-room facilities and expert personnel in Roseville will allow us to manufacture SiC chips for electromobility on an even larger scale,” said Dr. Stefan Hartung, the chairman of the Bosch board of management.

At an early stage, Bosch invested in the development and production of SiC chips. Since 2021, it has been using its own proprietary processes to mass-produce them at its Reutlingen location near Stuttgart. In the future, Reutlingen will also produce them on 200-millimeters wafers. By the end of 2025, the company will have extended its clean-room space in Reutlingen from roughly 35,000 to more than 44,000 square meters.

“SiC chips are a key component for electrified mobility. By extending our semiconductor operations internationally, we are strengthening our local presence in an important electric vehicle market,” said Dr. Markus Heyn, member of the Bosch board of management and chairman of the nobility solutions business sector.

Demand for chips for the automotive industry remains high. By 2025, Bosch expects to have an average of 25 of its chips integrated in every new vehicle. The market for SiC chips is also continuing to grow fast—by 30% a year on average—driven by the global boom and ramp-up of electromobility. In electric vehicles, SiC chips enable greater range and more efficient recharging, as they use up to 50% less energy, Bosch said. Installed in these vehicles’ power electronics, they ensure that a vehicle can drive a significantly longer distance on one battery charge—on average, the possible range is 6% greater than with silicon-based chips.

Semiconductors are key to the success of all Bosch business areas. The company recognized the potential of this technology early on and has been producing semiconductors in Reutlingen since 1970. They are used both in the automotive sphere and in consumer electronics. Production at the Bosch 300-millimeter wafer fab in Dresden started in July 2021. At nearly one billion euros, the wafer fab is the biggest single investment in the company’s history.

In its wafer fabs in Reutlingen and Dresden, Bosch has invested more than 2.5 billion euros in total since 200-millimeter technology was introduced in 2010. On top of this, billions of euros have been invested in developing microelectronics. Independent of the investment now planned in the United States, the company announced in summer last year that it will be investing an additional 3 billion euros in its semiconductor business in Europe, both as part of its investment planning and with the aid of the EU’s “Important Project of Common European Interest on Microelectronics and Communication Technologies” program.

New leadership at Bosch Rexroth

Bosch Rexroth, the Bosch Group’s drive and controls technology supplier, also announced that its President and Chief Executive Officer Gregory Gumbs will leave the company on July 1 (Figure 1). Gumbs, who joined the organization in late 2020, led increased business growth of the North American region and established a strong customer-focused and people culture.

“This decision was not taken lightly,” said Gumbs. “I have great respect for the leadership team, our associates and channel partners across North America. I am very confident in the strategy and in our talented team, which will ensure continued success and positive outcomes for our customers and the business. It has truly been an honor and privilege for me to serve and lead this team.”

In the interim, Reinhard Schaefer, current executive board member, will join the North American board to support the transition and identify the company’s next regional CEO.

Danfoss CEO redefines energy efficiency 2.0 at IEA conference

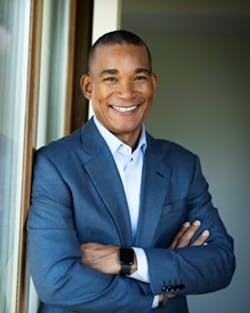

Danfoss President and CEO Kim Fausing (Figure 2) told the International Energy Agency’s 8th Annual Global Conference on Energy Efficiency in Versailles, France, that energy efficiency is a key tool to decrease energy demand, ensure energy security and mitigate climate change, and he says it needs more prominence in the net-zero narrative.

Fausing reflected on the progress that has been made in the year since the conference was held in Sønderborg, Denmark, where the Sønderborg Action Plan was adopted.

Fausing said, “In Sønderborg a year ago, we proved beyond a doubt that the value of reducing energy demand, along with increasing supply, is an essential yet overlooked component of the energy transition. And we illustrated that it’s good for business too, with most solutions having payback times of less than three years. In fact, Dr. Faith Birol even coined Sønderborg as the global capital of energy efficiency. This was certainly a turning point, but now is not the time to rest. Rather it is the time to implement, execute and follow-up on energy efficiency and machine productivity.”

While global energy efficiency progress reaching 2.2% in 2022, according to IEA, twice the average over the previous five years, this is still far short of the necessary 4% improvements needed annually for the period from 2020 to 2030 for the world to reach the Paris Agreement climate goals. Global energy demand grew by 1% in 2022. Without progress on energy efficiency, IEA states this would have been almost three times higher.

Fausing highlighted that the momentum for building out new energy supply continues to dwarf efforts to reduce demand through energy efficiency measures and called for an updated narrative about energy efficiency. Introducing the concept of “energy efficiency 2.0,” he said it is much more than simply reducing demand and it will become even more important as the clean energy transition accelerates. The world needs digital solutions such as the Internet of Things (IoT) and artificial intelligence (AI) to create the flexibility that energy systems will require as the share of renewables grow, Fausing added.

“Energy efficiency 2.0 means using electrification and sector integration to use our energy smarter, matching supply and demand. We know that excess heat—from supermarkets, data centers, industry, wastewater treatment plants—in the EU corresponds to the total energy demand for hot water in residential and service sector buildings. Yet, it’s mostly unutilized. Put simply, there will be no net-zero future without energy efficiency.”

Leaders relevant to this article: