2 misconceptions about selling industrial technology companies

Many owners of industrial technology companies who want to sell their businesses have misconceptions around the deal process. These misconceptions set them up for disappointment and can even kill the deal.

The first misconception we often see relates to confusion around how purchase price—the headline deal value—translates to net proceeds—what gets deposited in the bank—at close.

The second misconception relates to underestimating the time, effort and documentation required to survive late-stage diligence.

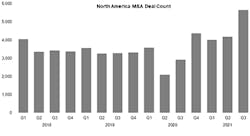

When COVID struck in early 2020, the buying and selling of businesses nearly came to a complete halt. The performance of many companies suffered, and buyers struggled to forecast future performance in light of COVID-related disruptions to operations, which made them hesitant to commit capital.

A number of factors spurred owners of industrial technology companies to consider selling in 2021, but we saw two of those factors most commonly cited as influencing owners to sell. The first and most obvious was the proposed increase in the capital gains tax rate from 20% to 40%, which would bring the capital gains tax rate closer to the income tax rates for top-bracket earners, significantly increasing the tax liability for business owners seeking to transact in coming years. This proposal guided expectations for most of 2021 but was revised in September to a more modest 5% increase or a 25% capital gains tax rate. This current proposal could be retroactive to September 14, 2021; however, there is still uncertainty around the specifics of what will be approved. These proposed tax changes have been a critical financial incentive for business owners to sell their businesses.

The second and most nuanced factor encouraging industrial technology company owners to sell all or part of their businesses stems from COVID-induced reflection. Even for owners whose businesses were not permanently affected by COVID, many saw their own or others’ earnings drop precipitously during 2020.

In our conversations with founders and business owners, we heard that observing their livelihood and life’s work in jeopardy over something completely out of their control was prompting them to consider taking some chips off the table and diversifying their net worth beyond their business.

2021 has been a remarkably hot year for the sale of industrial technology companies, but business owners should avoid entertaining unsolicited offers or launching into a sale process without fully understanding the process, particularly the level of scrutiny to expect during later-stage diligence. Most misconceptions around the deal process come in what we describe as the “final diligence” stage. Final diligence occurs after a buyer has been selected and a non-binding letter of intent (LOI) has been signed.

The two most common misconceptions we see involve misunderstanding the calculation of net proceeds to the seller and failing to anticipate the breadth and depth of late-stage diligence.

Net proceeds

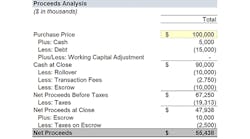

Without an understanding early in a process of the key adjustments that will be made to the purchase price to arrive at net proceeds, sellers can be disappointed when these adjustments are made clear as they near the closing of their deal (Figure 1).

The headline deal value, also known as the purchase price or enterprise value, is the starting point for calculating net proceeds to the seller. For the purposes of our example and for simplicity, we assume a $100 million purchase price. Transactions are typically contemplated on a cash-free, debt-free basis, and these are the first two adjustments to purchase price. In simple terms, any excess cash on the balance sheet belongs to the seller, and any debt—term debt, line of credit, equipment leases—also must be paid off by the seller at time of close.

The third adjustment to purchase price is for working capital. Working capital is calculated as current assets minus current liabilities. In intuitive terms, it is the amount of cash needed to run the business in ordinary course. For businesses with a lot of inventory and slow-paying customers, this figure is higher. For businesses that can delay payment to vendors and collect cash quickly, this figure is lower, even negative in some instances.

The calculation of the working capital adjustment is typically the most complicated of all the adjustments made to arrive at net proceeds, as it is subject to negotiation. The adjustment is defined as the difference between actual and an agreed-upon target or normalized level of working capital. Most letters of intent include language committing to a reasonable and fair calculation of a working capital target. The target, intended to represent a typical level of working capital, is often calculated as the average of the previous six or 12 months working capital at month-end.

If the actual working capital in the business at close is greater than the target, there would be an adjustment in favor of the seller equal to the difference between the two values, representing a positive adjustment to purchase price. Conversely, if the actual level is less than the target, the adjustment would be a deduction from purchase price. The intention of a proper working capital target is to avoid any adjustment at all and protect buyer and seller from unusual fluctuations in the business that would meaningfully influence the level of working capital delivered at close. For the purposes of our example, we assume this value to be zero.

The following adjustments occur prior to taxation of proceeds and include any sale proceeds that the seller invests in the new entity, known as rollover equity, any fees incurred in association with the transaction (including investment bank, attorneys and other advisors), as well as proceeds placed in escrow or representation and warranty insurance (RWI).

Typically, you will see a seller invest a portion of their proceeds in the new company only if they are being acquired by a private equity group. Though they will cede control of the business by owning less than 50%, they will retain a small but meaningful ownership percentage in the new company and benefit from future growth and exit of the business. This investment, known as rollover equity, is often attractive to private equity buyers as it signals the seller’s confidence in the business’s prospects. In contrast, strategic buyers, as a general rule, will acquire 100% of the business.

Next: transaction fees. Our model includes two of the principal fees associated with a transaction: a fee to the investment bank advising on the transaction and a fee to the group of attorneys representing the seller.

In addition to these, there may be other representatives employed on behalf of the seller, such as tax advisors. A seller may also give transaction-related bonuses to his key employees, especially to those who do not own equity in the business, to keep them motivated during the due diligence process. These bonuses would be paid out here, as well.

Following transaction-related fees, escrow is deducted. Escrow is proceeds held in reserve by a third party for a period as collateral against any claims against how the company was presented during diligence.

Typically, escrow is 5-10% of the purchase price. As this figure can be a large deduction from seller proceeds, insurance groups have constructed a variety of transaction-related policies to protect buyer and seller, known as RWI. In these policies, a much smaller percentage of seller proceeds is held as retainage (1-2%). Given the current deal environment, sellers are often able to persuade the buyer to pick up the cost of the policy premium.

The next line, net proceeds before taxes, is the closest approximation of the amount that will be deposited in the seller’s account at close. Of course, this does not provide a complete picture as taxes are owed on the proceeds. We refrain from providing any detailed tax guidance and encourage sellers to consult a tax specialist to understand their potential liability in greater detail. Last, any remaining escrow, once returned to seller after the specified period, often 12-18 months, will be another source of funds after these proceeds are taxed, as well.

The final line, labeled net proceeds, is a good estimate of the total economic effect of a sale transaction. Of course, the number in our estimate, approximately $69 million, is significantly lower than the headline value of $100 million. This figure could easily move either direction based on the company’s current cash balance and outstanding debt. This analysis also assumes a single seller with complete ownership of the business. For companies with multiple owners, these figures would be split pro rata at every stage.

Final diligence scrutiny

Figure 2: Juggling multiple high-priority request lists and coordinating across different departments of the company can become overwhelming.

The second most meaningful area of the sale process where business owners can lack clarity and proper expectations is around final due diligence. After signing an LOI it can feel like the process is almost done; we’ve selected a final partner and negotiated the purchase price and key deal terms. We must be close to a deal. Far from it.

Signing a LOI initiates what, for many owners, is a multi-faceted two-to-three-month scrutiny of the business unlike any they have faced before. While the buyer typically performs meaningful diligence before submitting an LOI, diligence after signing an LOI covers more areas of business at a far greater depth. Juggling multiple high-priority request lists and coordinating across different departments of the company can become overwhelming (Figure 2).

Financial diligence

- Typical duration: 4-5 weeks

- Involved parties: third-party accounting firm engaged by buyer

- Priority: highest

Sellers can expect financial diligence to begin early as this is not only an item of critical importance, but also a relatively lengthy process. Buyers will usually engage a third-party accounting firm to perform a quality-of-earnings (QoE) assessment. A QoE assessment is similar to an audit, but it focuses more on recurring cash flow than on earnings. While an audit is concerned primarily with the accuracy of the financial accounting, a QoE assessment is focused on the key drivers affecting cash flow including capital expenditures, working capital, one-time expenses, addbacks and adjustments, as well as trends in key financial metrics such as gross margin, revenue growth, product releases, sustainability of historical earnings and customer analysis.

This process typically begins with a lengthy, detailed request list for various financial documents, often in source form rather than on a consolidated basis. After receiving sufficient information, the third-party firm will arrange several calls with the seller to review key portions of the analysis and ask incremental, clarifying questions. Then the final report is issued to the buyer, which includes the accounting firm’s view on recurring cash flow for the relevant historical period. The goal of this analysis is for the buyer to verify financial performance through a trusted independent third party.

Common missteps in the financial diligence process include a lack of sophistication around financial reporting and messy or inconsistent financial statements. Difficulty and delays in providing the requested data can significantly delay the financial diligence timeline and will, in nearly all circumstances, extend the timeline to close. Most importantly, early hiccups in this stage of the process serve as a canary in the coal mine for buyers, who are unlikely to complete a transaction if there is a lack of clarity in the financials.

Legal diligence

- Typical duration: 4-6 weeks

- Involved parties: buyer legal team, seller legal team

- Priority: high

Legal work tends to start early in the diligence process. Attorneys representing the buyer will send over a requested list of items that is usually the longest and most detailed of all lists received during due diligence. Although the list is often lengthy, many of the items requested will be not applicable since the questions are designed to apply to a wide range of companies and situations. Critical documents requested include articles of incorporation, operating agreements, bylaws, amendments, legal organizational structure, cap table, stock transfer ledgers and credit agreements. Beyond straightforward requests such as these, the buyer’s legal team will also evaluate historical, current and threatened lawsuits, outstanding liabilities, customer contracts, employee agreements, confidentiality agreements, noncompete agreements, pension liabilities, real estate titles and leases, insurance claims, review of patents, trademarks, copyrights, trade secrets, and intellectual property, permits, licenses and governmental approvals. The list goes on.

Early requests focus on identifying and analyzing liabilities and sources of risk. Later in the process, the legal teams for both seller and buyer draft and negotiate the needed documentation to close the transaction, including a stock or asset purchase agreement and employment agreements.

For some businesses, legal diligence can be relatively straightforward. However, problems can arise if the seller finds it difficult to provide the requested documents. Scrutiny of existing liabilities can also put the deal at risk. In later stages of the process, having an experienced M&A legal team representing the seller is of critical importance in structuring the deal and negotiating the purchase agreement.

Tax diligence

- Typical duration: 2-3 weeks

- Involved parties: buyer third-party accounting firm (often same firm as financial diligence)

- Priority: medium

Tax diligence focuses on ensuring historical compliance with all relevant tax authorities: federal, state, local and foreign. This analysis will cover all types of tax, including income, sales, use, gross receipts and property tax. The buyer will request and evaluate all of these returns to ascertain if there are any potential hidden liabilities due to noncompliance. Any audits and correspondence with tax authorities will also be requested and evaluated. In addition, these groups will want to understand the processes and procedures in place to ensure compliance going forward.

While tax diligence can be relatively quick and painless, it also has the potential to derail a process. Our team has represented two clients in the past year where third-party diligence uncovered material potential tax liabilities. Fortunately, we were able to successfully navigate these situations with guidance from tax experts.

IT diligence

- Typical duration: 1 week

- Involved parties: varies, often internal when strategic buyer, can be third party for financial buyer

- Priority: low

Of all the diligence streams, IT is among the least disruptive. The request list, if one is provided, will be brief and cover topics such as hardware and software used on premises, Internet domain names associated with the company, security software used, description of any historical data breaches, privacy policies and procedures for resolving IT issues. At times, these items can be covered on a simple call in lieu of sending over a request list. Even when the review uncovers practices that fall short of industry standard, these can typically be rectified prior to or after closing the transaction.

Technology diligence

- Typical duration: 2-4 weeks

- Involved parties: varies, typically a combination of internal and third-party experts, especially when software is involved

- Priority: high (if core to the business)

The significance of technology diligence can vary based on the company and its reliance upon proprietary systems and processes. Some companies have straightforward business models that do not rest upon proprietary technology or patents. In most scenarios, technology and IP represent the majority of the value of an industrial technology company and will receive extremely in-depth analysis. Strategic acquirers of industrial technology businesses will often have in-house experts available to evaluate the technology. However, for companies acquiring technology in adjacent industries in which they have little experience, they will often hire third parties and patent attorneys to perform diligence on the core technology and related IP.

Technology diligence is tricky because sellers are often concerned about exposing proprietary information or trade secrets prior to close. Demonstrations of the technology, as well as solving representative problems, can be workarounds to this privacy concern. Third-party evaluators also provide a solution, as they can be given full access to the technology with limited competitive sensitivity. Their evaluation is protected by confidentiality agreements and will culminate in a written report, protecting the seller.

In technology businesses reliant on proprietary software, third-party evaluations are very common. This diligence work is focused on ensuring there are no dependencies on code written or held by other parties that may jeopardize the whole stack. This evaluation also analyzes for potential vulnerabilities to malware.

Insurance diligence

- Typical duration: 2-3 weeks

- Involved parties: typically buyer third party

- Priority: low

Insurance diligence occurs later in the process, given it tends to be more focused on the business from a go-forward perspective than looking for potential deal killers.

Insurance and benefits request lists include a history of claims, copies of all insurance plans including group life, disability, medical, dental, vision and unemployment plans, and any pending litigation or claims with respect to these insurance policies. The future owner of the business will want to understand how the company is protected by various policies and whether they currently have enough coverage. Heavy emphasis is placed on integration planning into the buyer’s business during insurance diligence.

HR and benefits diligence

- Typical duration: 2-3 weeks

- Involved parties: varies, often internal when strategic buyer, can be third party for financial buyer

- Priority: low

HR and benefits diligence also occurs later in the process and in many ways is focused on required integration tasks. HR requests include invoices for the various health benefit plans, premiums paid by employees for these plans, roster of employees with hire date, current salary, job title, information around hiring processes and turnover, detail around 401(k) policies, utilization and other benefit plans, and understanding of bonuses and other incentive plans. Regardless of whether the company is being acquired by a strategic or financial party, the buyer will want to understand the current level of compensation, coverage and benefits offered today and plan for the addition of new members to their existing plans. All this information flows into drafting employment agreements and, after close, onboarding the new employees.

Environmental diligence

- Typical duration: varies based on scope, 2-6 weeks

- Involved parties: environmental firms

- Priority: medium/high

Environmental diligence can range in importance from a simple check-the-box exercise to a meaningful hurdle to clear. In situations where environmental diligence is expected to be a formality, this portion of the process is often delayed until near the end of the process as a desktop review and analysis can be completed quickly.

Buyers who will be acquiring any real estate in the transaction typically require a Phase I environmental site assessment (ESA) of the property unless a Phase I evaluation has been performed recently. A Phase I is performed by an environmental firm and will require a site visit. A typical Phase I ESA involves investigating the history and use of the property, reviewing aerial photographs and topographical maps, a visual site inspection of the facilities, investigating any chemical use, storage and disposal. This process usually takes about two weeks from initial document review and site visit to final Phase I report delivery.

In most situations, a Phase I assessment is sufficient; however, for some companies dealing with hazardous materials or known for pollution concerns, buyers may require a Phase II ESA. A Phase II evaluation is much more in-depth and can involve drilling to test soil samples for contamination, sampling building materials for asbestos, lead and other hazardous materials, installing groundwater monitoring wells and collecting groundwater samples, monitoring ambient air quality and more. A Phase II evaluation commonly leads to meaningful negotiation over resulting liabilities that may surface.

According to Pitchbook, a source for private market insights, trend analysis and predictions, specializing in venture capital, private equity, mergers and acquisitions, the number of mergers and acquisitions has risen since the significant drop in the second quarter of 2020, during the onset of the COVID-19 shutdown. Rob Langley, managing partner at Align Capital Partners, a Dallas-based private equity firm, says his team has been evaluating a record number of deal opportunities throughout 2021. “Deal flow is up 40% in 2021 for us versus a typical year,” he notes. “There are three primary drivers: some spillover from deals that didn’t get done in 2020 due to COVID, pending tax changes and a healthy economy. The most important of these is the third, and, with labor shortages and wage increases, the outlook for industrial technology is quite positive.” Steve Bartz, transaction attorney at Greenberg Traurig, a multinational law firm, echoes a similar refrain. “Deal activity has continued at a torrid pace in 2021, building on the resurgence at the end of 2020,” he says, citing significant tailwinds from stimulus measures, pent-up demand from the first wave of the COVID-19 pandemic and, perhaps most importantly, record-low cost of capital coupled with the need to deploy it.

Commercial diligence

- Typical duration: 2-3 weeks

- Involved parties: often internal; occasionally involves a third-party expert

- Priority: high

Commercial diligence typically comes late in the process and serves two distinct purposes: first, to validate current business performance and, second, to discuss go-forward planning, strategy and integration. The first piece, validating current business operations, often involves site visits to tour facilities, conversations with management and calls with customers. Customer calls are highly sensitive and usually delayed until shortly before close and performed on an anonymous basis to preserve confidentiality. This investigative process works hand-in-hand with the forward-looking planning. The future owner of the business, whether strategic or financial, will want to have a clear plan for the direction of the business. Hopefully high-level alignment on the future of the business has been decided and agreed upon prior to signing an LOI, but in these subsequent sessions the details and practical steps are fleshed out.

Often these sessions are exciting and help motivate both buyer and seller to get across the finish line, but they can also uncover places where there is misalignment on the vision and direction of the company. In the other portions of commercial diligence, the buyer is focused on confirming the quality of the company’s product, service and market position. At times third-party experts are used to perform market studies to explore the size and growth of the served end market. Ultimately, customer calls are usually the critical item that determines the buyer’s view on the quality of the company’s offering.

In closing

Selling a business is usually the largest and most complex transaction in which anyone is involved in their life. There is a lot riding on the final outcome and, unfortunately, there is a lot that can go wrong between agreeing to sell a business and actually receiving payment for it. As we have noted, the two most common problems that sellers of businesses run into is failing to understand how the purchase price will be winnowed down to net proceeds and being unprepared for the intense scrutiny of late-stage due diligence.

Of course, neither of these hurdles is insurmountable and hundreds of businesses are sold in the United States every year, especially this year, thanks to a confluence of events. Key to a successful close of a business sale is having access to experts, such as M&A attorneys, accountants and investment bankers, who have been through the process many times before.

About the authors

Sponsored Recommendations

Latest from Financials

Leaders relevant to this article: