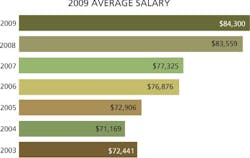

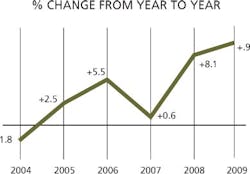

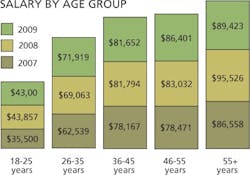

If you're not concerned about your job, then you are either lucky or oblivious to the events swirling around you. But you're definitely in the minority. In our Ninth Annual Control Design Salary and State-of-Mind Survey, 62% of the respondents said they were concerned about job security. Of course, that number isn't surprising, but the slight up-tick in annual salary is. Despite reports of reduced work hours and pay in manufacturing and machine-building, the average salary for a controls engineer increased by almost 1% to $84,300, according to our latest research.

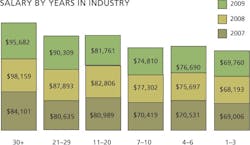

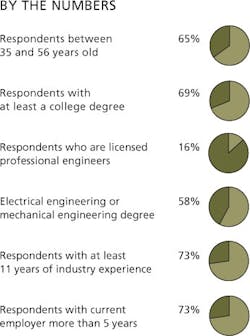

Similar to our survey results in previous years, more than 90% of participants are over age 35, and 73% said they're controls-and-machine-automation veterans of more than 11 years.

Headed for a Breakdown

While company management's annual salaries went down from last year ($95,922 to $91,917), all other job descriptions we surveyed said their salaries increased. Engineering and design, as well as research and development, increased by more than $3,000 over 2008 reported earnings. But the biggest gain was shown by technical support, which bulked up well over 10% to $77,289.

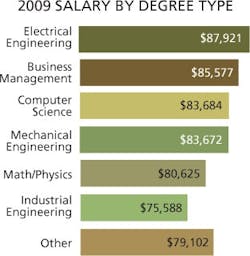

Electrical engineering is the most popular degree held by our participants (41%) and still holds the top spot for compensated degrees at $87,921, but business management and computer science degrees showed surprisingly huge jumps in our survey, ramping up to $85,577 and $83,684, respectively. Mechanical engineering degrees showed just a slight increase at $83,672. While the type of degree saw some major shuffling from 2008 results, the level of education still held true to form. Doctorate degrees dipped only slightly from $109,860 to $107,778 at the head of the pack. The remainder of education levels held fairly true to the salaries of 2008, with more education translating into a higher salary. Master's degrees demanded $98,582, and four-year college degrees earned $86,244. Almost 70% of respondents to our survey hold at least a four-year degree.

Cashing in on Education

Despite almost two-thirds of survey participants saying their companies laid off workers in the past 12 months and another 55% saying they had hiring freezes in place, 63% of participants said their companies offered continuing-education reimbursement, and more than half relied on supplier-led classes. Mentoring (39%), internships (33%) and company classrooms or labs (31%) also were cited as being offered by participants' companies.

Survey respondents said that when they began their careers as controls engineers, supplier classes were important training tools for them (51%). Mentoring also was important, cited by 49% of participants. Reimbursed continuing education (40%) and first-year on-the-job training (33%) also ranked fairly high.

Everything Stays the Same

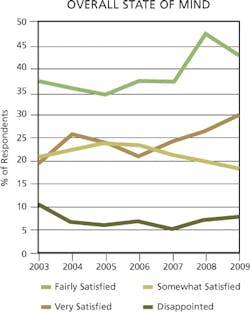

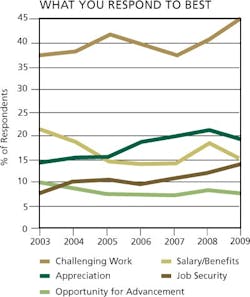

Despite the lackluster economy and job concerns, the number of survey respondents who are fairly satisfied or very satisfied with their jobs remained largely unchanged, hovering just under three-quarters (43% and 30%, respectively). Challenging work still remained the No. 1 motivator for controls engineers, and in fact this year it inched up slightly, recognized by 45% of participants as the thing they respond to best. Not surprisingly in these economic times, appreciation and salary/benefits fell a few percentage points (19%, 15%), but all motivators maintained their order of importance from the previous year.

Methodology

Earlier this year, we emailed invitations to our subscribers and included a link to the survey in several of our newsletters. Usable survey responses were returned to us from 502 participants. Results were analyzed and additional interviews were conducted. For specific information about the survey results, contact [email protected] or phone toll-free 800/984-7644, ext. 444.

Tim BlackburnSenior Electrical/Instrument Engineer

Orbital Engineering (www.orbitalengr.com)Pittsburgh, Pa.

Tim Blackburn sees the economic downturn and its consequent operational downtime as an opportunity to be constructive. "The natural inclination during a slump is to pull back, reserving capital, but in reality this is the perfect time to retool while the interruptions will not impact production capacity adversely," he explains. "Once the economy rebounds, you will not have time to add new technology and skills. You will be too busy turning out product."

Blackburn's path into engineering was fortuitous—well, maybe not for the wood shop involved.

"While I was in high school, the wood shop burnt during the summer of my freshman year, so I took a course in mechanical drafting in place of wood shop," he explains. "I loved the whole concept of developing the designs that others would build." One associate's degree in mechanical engineering design from Penn State and a B.S. in electrical engineering from Point Park College later, Blackburn found a mentor who showed him the path.

"Many of the skills I use daily were learned from the first engineer I worked with as a young designer at Koppers," he recalls. "Mr. Edelman was an incredible mentor who took me under his wing. Each morning, we would both come to work early and have ‘class' on a topic that was relevant to the current project. He also made sure that I had the opportunity to attend trade shows and vendor training."

And that discipline of staying current through regular training has carried over throughout Blackburn's career. "Given the current economy, online courses have some appeal, but they lack personal involvement that can be such a significant part of the learning experience," he says. "I take advantage of the training programs offered locally and nationally by the trade organizations, such as ISA. These programs are developed and conducted by professionals for professionals."

Ken Moehring

Equipment Engineering Manager

Belcan Engineering (www.belcan.com)

Cleveland

"Whatever measures you can take to retain your workforce, rather than have a reduction in force, is the right thing to do," says Ken Moehring. "We're doing a lot of in-house training now. We're trying to streamline our engineering activities. We've worked with our IT people to generate macros, and we've taken this opportunity to create in-house improvements to the way we do our work. We're also taking time to strengthen our in-house SolidWorks knowledge and doing some standardization for drawings. If companies have to reduce costs, the best step is to cut back on hours instead of reducing headcount, but you have to temper that with people's financial issues. Maybe higher-ranking employees can afford it better than the lower-paid ones."

Moehring earned his mechanical engineering degree at Cleveland State University, but co-op experience was a big benefit for him. "I went through a co-op program at Eaton Axle in Cleveland," he says. "Co-op experience is really great because I had a stint in the assembly area and testing and was exposed to a lot of things." Moehring's affinity for engineering was manifested as a youth in his interest for all things mechanical. "I built go-karts growing up in Cleveland," he says.

Nurturing his professional development was easy. "There was some advanced technical training through General Electric," says Moehring. "I rely on vendor courses and sometimes distributor technical presentations on lasers. We design and build special machinery, so it's not straightforward assembly. We marry things up. My typical role is technical management and also project management."

Belcan is an equipment engineering and design house, explains Moehring. "We don't have any big system that we're keeping alive," he says. "Everything we do is custom-built, and some of it is dictated from a controls standpoint, which is dictated by the customer's system, unless there's some proven need where something is superior and we might guide them that way."

Michael MeivesMechanical Designer

Thiele Technologies (www.thieletech.com)Kiel, Wis.

Michael Meives always has tinkered around with stuff. "My father was an R&D engineer at a packaging company," he explains. "I was originally a machinist, and at the same time I was doing design projects. I've been doing R&D design for the past 15 years. I was with Nigrelli Systems, which was acquired about a year-and-a-half ago by Thiele Technologies, which itself is part of the Barry-Wehmiller Group."

At Nigrelli Systems, where peak employment was around 75 people, education was paid as long as employees maintained their grades, so Meives took advantage of the opportunity while he was a machine shop foreman. "I've taken lots of classes—electronics, servo control—at tech schools and colleges. I've taken vendor classes when they've been available, primarily in the controls area. Thiele is a much larger group than Nigrelli. Thiele has some continuing programs. We're still learning our way through the acquisition."

The change from a smaller to a larger company has introduced standardization into Meives' organization. "I'm learning SolidWorks, which is standardized across the Barry-Wehmiller Group," he says. And the economy has impacted Thiele as much as it's affected every other company. "We've been requesting employees take additional time off," says Meives. "They've been doing that throughout the Barry-Wehmiller companies. That's a pretty fair way of going about it. They are trying to maintain. They haven't done any layoffs, which is pretty good for a company this size."

Tom DonnellySenior Electrical Engineer

Domtar (www.domtar.com)Ashdown, Ark.

Tom Donnelly, whose interest in electronics began in grade school when he would build radio kits from the local Radio Shack, already holds a bachelor's degree in EE from North Carolina State University (NCSU), but he continued studying and earned an MBA and is now in the process of completing his master's degree in EE through online classes at NCSU.

Allowing valuable employee knowledge to escape isn't the answer during tough economic times, he believes. "Some companies are downsizing arbitrarily," he says. "They cut back and don't know where or how much. Then they have to scramble to rehire what they lost. Before they make those decisions, those companies need to take a better look at what they really need in terms of personnel and skills, now and down the road. I've heard of a few cases where some companies cut back too much."

Domtar is the second largest producer of communications paper, says Donnelly. And legacy automation systems, like veteran employees, often can be expensive to replace or remove. "We don't buy new technology as soon as it comes out," he explains. "We're right on the edge of state-of-the-art, but there are reasons to keep legacy systems. They're pretty reliable, but parts are difficult to get. A lot of times there aren't economic reasons to replace the equipment. Increased productivity normally isn't there for the price."

Continue Reading

Leaders relevant to this article: