CONSIDERING THE media hype and the glowing and imaginative forecasts made by many industry analysts, youd think not being involved in RFID applications at some level must mean youre missing the boata veritable luxury liner if you listen to the analysts. Some of them say RFID technology undoubtedly will transform the way business is done, much like the effect of PCs and the Internet. In reality, a check on the state of RFID in industry, and in machine automation in particular, suggests the RFID boat is little more than a dinghy.

For most machine builders, barcode and 2-D matrix code placement in the machine environment still dominate part, assembly, pallet, and carton/package identification and tracking. The cost of implementation, reliability, sensing distance, data accuracy and other limitations apparently have slowed the projected stampede to immediate RFID installations, originally suggested by the initial U.S Department of Defense (DoD) and Wal-Mart initiatives.

For reference, General Motors recently built a comparison between RFID and barcode technologies. Automotive companies have been using RFID technology for many years to identify, track, and sequence parts on assembly lines. Two-dimensional (2-D) matrix technology is added to the mix for a more complete comparison (See Figure 1).

FIGURE 1: GMs RFID, BARCODE, 2-D MATRIX COMPARISON

| Attribute |

RFID |

2-D Matrix |

Barcode |

| Technology |

Radio frequency transmission |

Optical |

Optical |

| Line of sight |

No |

Yes |

Yes |

| Read/write capability |

Yes |

Read-only |

Read-only |

| Embed data |

Yes |

Yes |

Yes |

| Reusable |

Yes |

No |

No |

| Sensing distance |

Varies, but < 15 ft. |

Limited to inches |

Limited to inches |

| Susceptible to false readings |

Medium (High around high metal density environments) |

Low, but contrast related |

Low |

| Tag/label cost |

High |

Low, but dirt sensitive |

Low, but dirt and label damage sensitive |

The figure suggests some significant advantages in implementing RFID. No line of sight, distance, and read/write capability seem to separate RFID technology from the others. However, for many users, tag costs are a huge initial investment.

According to AMR Research, more than half of potential users looking at RFID implementation indicate that cost savings is the key driver behind possible implementation.

Because RFIDs tag costs are still relatively high, ROI is stretched over a longer period than for 2-D matrix or barcode. In particular, 2-D matrix has been most effective when embedded on parts and assemblies (direct part marking or DPM). These embedded labels can track parts and assemblies through an entire manufacturing process.

RFID technology appears stronger in inventory management applications. Supply chain management, tracking, warehouse control, location ID, and work-in-process ID are applications where RFID is recommended. Industrial OEMs that build conveying and other automated material handling equipment could find warehouse systems and assembly lines impacted by this implementation trend.

Another key factor is interference. Since RFID readers collect data from tags several times a second, false readings can accumulate very quickly creating a database mess. If labels are reasonably clean, 2-D and barcode readers are considered far less susceptible to false reads. To that end, barcode and some 2-D printers have built-in verification to ensure that the label just printed meets all specifications of the reader used in the application.

Despite these limitations, many industries are forging ahead, some driven by compliance requirements, others driven by potential liability issues. For example, the FDA favors RFID technology for track-and-trace data collection. As a result, several pharmaceutical companies are looking at RFID technology for real-time location identification on many types of drugs to prevent counterfeiting and contamination. For these applications, the larger decision lies in which protocol or frequency to use. The two currently available are high frequency (HF) and ultra-high frequency (UHF). A new standard, UHF Gen2, was ratified in December, 2004, to provide functionality missing in prior standards, especially for enterprise adaptation and support. The HF band at 3.56 MHz spec appears to work best for pharmaceutical companies.

Many vendors have adapted their respective tag and receiver technologies to meet these Gen2 standards. Since the standard ratification, Gen2-compliant product introductions have come from Avery-Dennison, Symbol Concepts (a high-profile installation at a Social Security Administration facility in Baltimore can be viewed at http://www.sysconcepts.com/pdf_documents/press/SSA_Enterprise_PR.pdf), Alien Technology, Tagsys, Omron Electronics, Texas Instruments, and others. These present myriad potential solutions and add some sorely needed credibility to the market.

More recently, semiconductor manufacturer STMicroelectronics launched its RFID Gen2 chips. These EPCglobal, Gen2-certified chips include 128 bits of user memory and support commands such as block erase and block write. These chips are offered as inlay silicon in raw wafer or processed wafer forms.

Other open standards impacting RFID implementation include ISO 18000 EPC Types 3 and 4, IEEE 802.15.4 and IDTechEx. These standards opened the door to new short-range wireless communication technology developments such as WiFi and ZigBee.

A sampling around the country finds little RFID required, some 2-D matrix, and mostly barcode, if theres any tracking required at all. We assist integrators on error-proofing mostly using 2-D vision, barcode for part tracking, but were asked for RFID only for error-proofing, says Brian Premock, business unit manager for eData Solutions at Cross Automation, a regional solutions provider. In the RFID case, the part number/style is selected at machine setup for the particular machine to certify all fixtures are correct before running production. Eight-millimeter button tags are embedded in the steel face of the fixture, and the intelligent tag reader checks the fixture identification against the database, notifying the operator if theres an error.

Given that there appears minimal activity at the machine build levelalmost all applications found are being retrofitted to existing machines by the end userRFID has little impact on machine builders so far.

RFID activity appears to be far below analyst predictions. A recent announcement by Alien Technologies, a leading source for RFID technology, that they are delaying their IPO due to market conditions might be telling about RFID installations. Alien also notably reports that staff reductions are expected.

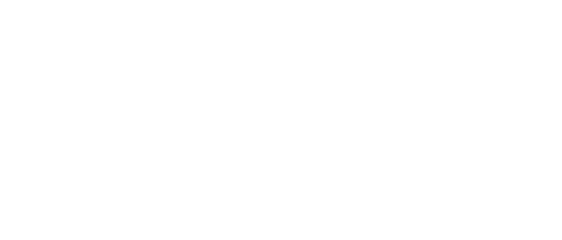

This slowing of RFID installs suggests that machine builders might want to focus on factors that allow them to participate in the huge, ongoing legacy system replacements. One such opportunity lies in the middleware layer for delivering collected information, regardless of the technology installed. Middleware is that layer of application software that can be connected through various methods to many machines to collect whatever data is required by the enterprise (See Figure 2). Data collection, manipulation, filtering, sorting and networking fits barcode, 2-D, and RFID data capture requirements.

FIGURE 2: MIDDLEWARE MIGHT BE WHERE IT'S ATIf this continues for the next year or two, machine builders might be better off to put their money on improving existing installations and new machines for new plants rather than worrying about jumping into the RFID circus, unless specifically requested by a customer. Even then, a thorough analysis of the application might suggest an alternative technology providing a quicker ROI.

| About the Author |

Sponsored Recommendations

Leaders relevant to this article: