Automation Equipment Set to Surpass Pre-Recession Market

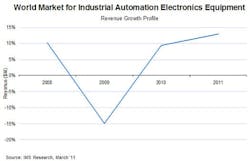

Following initial reports of a strong first quarter for industrial automation electronics equipment (IAEE), IMS Research predicts 12.9% market growth in 2011 to a projected worth of $97 billion. The latest forecast has been upgraded 1.5 percentage points from initial predictions, and is more than double the historic annual average of 6.2%.

“The reason for the upgrade is coming from a continued strong performance of machinery production in 1Q11,” explained Jenalea Howell, IMS Research analyst. “Machinery production experienced several quarters of very strong growth during 2010, and initially this was thought to have cooled off. But after 1Q indicators came in, it seems that the strong performance has lasted into 2011.”

Growth in the IAEE market—including products such as motors, drives, operator terminals, PLCs, etc.—relies heavily on machinery production, which performed exceptionally well last year. “Equipment used more in discrete manufacturing grew in 2010 as machinery production began to recover,” Howell said. This is in contrast to key process equipment markets, which declined in 2010. “Process equipment relies much more on capex budgets, and as large projects did not return in 2010, growth for process equipment also did not return.”

IMS predicts that the strongest performances this year will again come from Eastern Europe and China, leading to global growth of 9.8% for machinery production during the year. Most of the growth has to do with the developing status of the regions, and their low wages and low cost of producing machinery, Howell said, but also with their very high machinery production levels. “China’s machinery production market is forecast to grow 17.0% in 2011, while the IMF forecast China’s GDP to increase 9.2% in the same year,” she said.