Automotive industry employs 1 millionth robot

Operational stock of 1 million units moved the automation bar even higher in the automotive industry, with the largest number of robots working in factories around the world (Figure 1). This represents about one-third of the total number installed across all industries, according to the International Federation of Robotics (IFR), the voice of the global robotics industry.

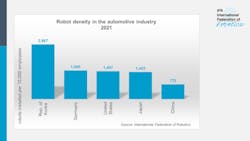

Robot density is a key indicator, illustrating the level of automation in the top car-producing economies (Figure 3). In the Republic of Korea, 2,867 industrial robots per 10,000 employees were in operation in 2021. Germany ranks second with 1,500 units, followed by the United States counting 1,457 units and Japan with 1,422 units per 10,000 workers, according to IFR.

Ambitious political targets for electric vehicles could be forcing the car industry to invest. The European Union announced plans to end the sale of diesel- and gasoline-fueled vehicles by 2035. The U.S. government aims to reach a voluntary goal of 50% market share for electric vehicle sales by 2030, and all new vehicles sold in China must be powered by new energy by 2035. Half of them must be electric, fuel cell, or plug-in hybrid, with the remaining 50% being hybrid vehicles.

Most automotive manufacturers that have invested in traditional caged industrial robots for assembling are also investing in collaborative applications for final assembly and finishing tasks. Tier 2 automotive parts suppliers are slower to automate fully. Yet, as robots become smaller, more adaptable, easier to program and less capital-intensive this is expected to change, according to IFR, which represents national robot associations, academia and manufacturers of industrial and service robots from more than 20 countries.